Chinese government faces a credibility deficit on its ‘old’ policy agenda and will need to act with urgency if it wants to lift business and consumer sentiment, economists say

cross-posted from: feddit.org/post/1045378

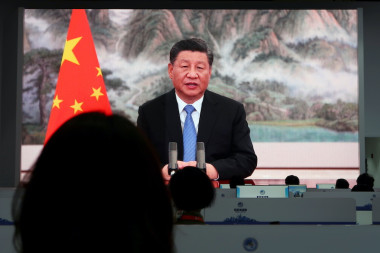

Analysts say China faces pressure to act on decade-old economic policy promises that it repeated at its leadership meeting last week.

With imbalances in China’s economy deepening, threats of lingering deflation, plus weak demand at home and increased hostility towards its export dominance abroad, national leaders chose policy continuity rather than any structural shifts at the twice a decade political event known as a plenum.

[…]

Analysts say China faces pressure to act on decade-old economic policy promises that it repeated at its leadership meeting last week.

With imbalances in China’s economy deepening, threats of lingering deflation, plus weak demand at home and increased hostility towards its export dominance abroad, national leaders chose policy continuity rather than any structural shifts at the twice a decade political event known as a plenum.

[…]

Huge inequalities, credibility deficit

China’s pledges to boost domestic demand, reform a Mao-era internal ‘hukou’ passport system blamed for huge rural-urban inequalities, strengthen rural land rights or improve social security also date back to at least 2013.

In reiterating a policy agenda with a mixed track record, Beijing faces a credibility deficit it did not have a decade ago and will need to act with more urgency if it wants to lift business and consumer sentiment from near-record lows, economists say.

Unusually for a plenum, as they tend to be vague on implementation timelines, Beijing committed to meet its policy goals by 2029. But the concrete deadline failed to inspire investors.

[…]

China is betting on high-tech export products becoming a new driver of growth that compensates for the dwindling returns on infrastructure investment and the growing writedowns it faces after its giant real estate bubble popped in 2021.

That bet is unnerving Washington, Brussels and other capitals that argue Beijing is driving industrial overcapacity in various sectors that cheapen Chinese exports and threaten manufacturing jobs around the world.

It also concerns many economists who have argued the world’s second-largest economy needs to reduce its over-reliance on external markets and debt-fuelled investment and stimulate household consumption instead.